The words like “Stock market crashed”, “Government bailout”, “End of American capitalism”, “Major Banks Collapse” and “Trillions of dollars wiped off” will always linger in the minds of people who have lived through the 2008 stock market crash and lost most of their money. In the biggest single intraday point loss ever, Dow Jones fell nearly 778 points after $700 million government bailout plan was rejected by the house.

In spite of having the world class intelligence and state-of-art technology, it is not uncommon for experts to miss the blind spots and make mistakes. Market has always been and will always be unpredictable so before you even think about any market based investment, it is imperative to understand that market changes every moment. It has certain characteristics and it is highly impossible to predict the behavior of the market. Several events such as- Income statements, Balance sheets, Earning reports, News, Economic reports, Federal announcements, Terrorist attacks, Analysts’ opinion and recommendations and Technical indicators may have a severe impact on the market’s behavior. Old trends and patterns do not determine the future direction of the market. Here are some of the important factors that you need to consider while you try to determine the future behavior of the market:

Volatility

Stock markets are volatile. Price changes of several percentage points within a short period are common. Markets usually react to news events, such as corporate earnings, government economic reports and geopolitical events. Software algorithms and automated trading strategies, along with the increased participation of investors, have increased the complexity and volatility of stock markets. You can hedge against market volatility by diversifying your portfolio. Successful investors ignore short-term fluctuations because stock prices reflect the underlying fundamentals over time.

Selection

Markets offer a wide selection of stocks to suit different risk tolerances and financial objectives. Aggressive investors can buy the stocks of newly listed companies and growth companies. Although these stocks are riskier than the stocks of established companies, you could benefit from significant price appreciation. Conservative investors could buy dividend-paying stocks, which generate regular income and some potential for price appreciation. You can find stocks from major industry sectors and sub-sectors within each industry. For example, you could invest in microprocessor and software companies within the technology industry and in department stores and specialty retailers within the retail industry.

Liquidity

Stock markets provide liquidity because they bring together investors and businesses from all over the world. Liquidity results in narrow bid-ask spreads, which means small differences between what buyers are offering and what sellers are asking for stocks. The result is order fills at favorable prices. Information technology plays a role by increasing the speed at which the markets execute trades and disseminate information to investors and other market participants. The free and transparent trading that takes place in the stock market prices is according to demand and supply, bid and ask. In this way it provides liquidity for investors seeking to transact sales of their holdings through this active pricing mechanism.

Global

North American and other stock markets are interconnected and interdependent. For example, Asian and European companies list on North American exchanges, while U.S. and Canadian companies list on European and Asian exchanges. Individual and institutional investors can trade stocks using 24-hour electronic communications networks. A stock market drop in Tokyo overnight can spread to Frankfurt in the early morning hours and hit New York in time for the opening bell. Similarly, news events in Europe can ripple through global stock markets in minutes.

Regulated

Regulations are necessary for fair and efficient markets. The U.S. Securities and Exchange Commission regulates the U.S. securities industry, along with the New York Stock Exchange and other markets. Securities laws ensure that investors and other market participants have access to the necessary information in a timely manner. The stock market provides a degree of protection to investors through oversight by the SEC, FINRA and other legal regulatory and self-regulating bodies on state and professional levels that serve to create an organized and liquid group of stock exchanges and stock trading platforms.

Gains and Losses

You are not guaranteed to make money when you invest in the stock market. But unlike with savings accounts, certificates of deposit or similar investments with fixed-rate returns, there is no limit on the money you can make in the stock market either. If you sell stock for more than you paid, you record a gain. Sell it for less than you paid and you incur a loss. Either could have tax ramifications.

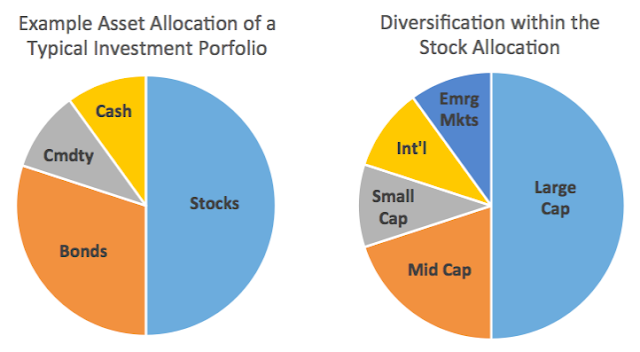

Diversification

Just as there is safety in numbers, there is security in diversity. Investing in more than one company's stock could protect you. Should the price of one company's stock plummet, gains in others might minimize your overall loss or perhaps even increase your total return. Mutual funds are popular among investors because they allow you to spread your investment among shares of several companies. You also can diversify by yourself by directly buying shares in different companies.

Stock Categories

Mutual funds and investors often focus on stocks with similar characteristics. Income stocks pay large dividends, but their prices do not rise much, according to the New York Stock Exchange’s Learning Center. Established companies with smaller dividends but steady prices are considered blue-chip stocks. Growth stocks belong to young companies that pay little or no dividends but offer greater chances for long-term price increases – or decreases. The prices of cyclical stocks, like those of home builders and automobile manufacturers, fluctuate with economic expansions and slowdowns. Conversely, defensive stocks, such as those of food and beverage manufacturers, maintain their values during recessions.

Indicators

Number of shares traded, closing prices, the change from their previous prices and the 52-week highs and lows are among the more rudimentary measures of a stock’s performance. Price-to-earnings ratio also is a standard. If, for example, a share sells for $50 and the company earned $5 a share, then the P/E ratio is 10. Investors might buy if they feel the ratio is low and that the price might rise. Or they might sell if they expect the price to soon drop because they consider the ratio to be too high.

Bulls and Bears

Do you see the proverbial glass of milk as half-full or half-empty? Your answer would indicate if you were a bull or a bear. Bears expect the stock market to drop while bulls bet that it will rise. Similarly, when prices generally decline over a prolonged period of time, it is considered to be a bear market. Sustained increases are called bull markets. You might buy or sell stock based upon whether you expect the market to rise or fall.

Booms and Busts

Easy come and easy go. Investors occasionally push prices of hot stocks or industries, or even the market as a whole, to unsustainable highs. The inevitable bust then follows. For example, stock prices soared for companies that capitalized on the adoption of the Internet in the late 1990s. University of Maryland researchers found that investors poured $880 billion into the telecommunications industry from 1997 to 2002, only to see half of it dissipate within the next five years.

Growth Capital

Issuing of stock is the cornerstone of capital formation for enterprise in capitalist economic systems. The stock market provides a way for companies to issue stock to the investing public.

Transparency

The public nature of trading maintains transparency in financial transactions. Efficiency, growth, freedom and variety are all possible because of transparency that allows all participants to access the bid and ask prices of all securities traded on the market and because all participants have access to the same information.

Economic Indicator

One of the ten components of the Leading Economic Indicators is made up of the Standard & Poor's 500 Stock Index, one of the major stock market indexes. The direction of trading activity in the stock market provides an indication of the state of commerce and overall confidence in the economy.

Regulated Risk/Reward

An organized and regulated stock market serves as a way for investors who seek large returns on their investments to access organized, liquid, regulated and transparent risk investing.

(Reference: http://www.zacks.com)